Many people face cash flow problems from time to time, and this may result in challenges in paying off certain bills or expenses, especially when there is a deadline to do so. In those situations, a personal loan might be able to help you ease your financial burden temporarily.

As a matter of fact, you’d want to look more closely at low interest rate personal loans or if possible, lowest interest rate personal loans in Singapore.

Curious? Read on to find out everything you need to know about personal loans and low interest rate personal loans.

What are personal loans?

Personal loans can be secured or unsecured loans. When you receive a personal loan, the cash is directly deposited into your bank account. As it is very flexible, it can be used to pay for large personal expenses such as medical bills, funerals, weddings, renovations, or even travel.

Some of you might be wondering, is it possible to get a low interest rate personal loan in Singapore? Where can you find the lowest interest rate personal loan and how can you make use of them?

Let’s take a closer look.

Where can you find the lowest interest rate personal loans in Singapore?

There are two places where you can find low interest rate personal loans in Singapore — banks and licensed money lenders.

1. Banks

Banks like HSBC, DBS, OCBC, UOB, etc, offer personal loans with the lowest interest rates from as little as 3.4% per annum. Some banks might even offer 0% interest rates – and you might be wondering, is this too good to be true?

There’s no free lunch in the world, so yes, 0% interest rate personal loans often come with a catch – they often involve high fees, including processing fees and other charges, so their effective interest rate (EIR), which includes processing and administrative fees, are actually higher.

2. Licensed money lenders

An equally reliable and competitive option is to take a low interest rate personal loan from licensed money lenders. You can find them all over Singapore, including Chinatown. Licensed money lenders generally offer personal loans with interest rates of 1 to 4% per month, assuming the loan is repaid on time.

Banks vs Licensed money lenders

If you compare the two, interest rates from banks tend to be lower compared to licensed money lenders. However, banks have stricter eligibility criteria, such as requiring borrowers to have a good credit score and a steady source of income of at least S$20,000 or $30,000 per year. In addition, they impose a minimum loan amount.

Personal loans offered by licensed money lenders are often of a smaller amount as compared to those you can get with banks. The credit requirements are less stringent, thus increasing your chances of getting the loan approved. This makes money lenders suitable for small or quick cash needs.

The interest rates of licensed money lenders are also fixed, as compared to banks’, which may fluctuate according to the market.

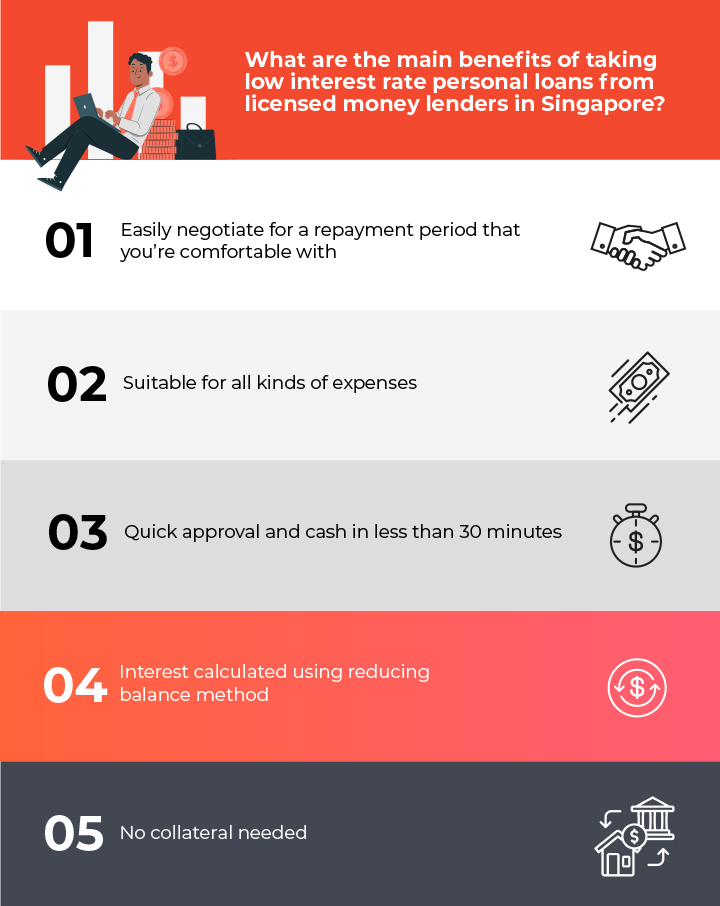

How can you gain from taking low interest rate personal loans from legal money lenders in Singapore?

There are many benefits to getting low interest rate personal loans in Singapore from money lenders.

1. Flexible repayment period

The repayment period is negotiable before you sign the loan contract, so make sure you negotiate for a period that you are comfortable with, as late repayment will incur late interest and charges.

2. Can be used for any expenses

The personal loans you secure with money lenders can be used at your discretion for a wide range of needs, for example, to fund your dream wedding or expand your business.

3. Fast approval

Licensed money lenders also have a faster approval rate than banks; most loans can be approved in less than 30 minutes. This makes licensed money lenders the perfect choice if you need urgent cash loans for time-sensitive matters like funeral expenses or medical emergencies.

4. Reducing interest rates

Interest rates for loans with licensed money lenders are not flat but reducing. This means that your interest rate is calculated based on the outstanding amount at the end of a specific period. For example, if you borrowed $14,000 and have repaid $2,000 of the principal loan amount (not including interest), interest for your next payment will be calculated based on the remaining $12,000.

But remember, the lowest interest rate personal loan may not necessarily always be the best. There are other factors to consider such as repayment period and high late interest fees, etc. Always read the loan contract carefully and be aware of all terms before committing to it.

5. No collateral

Personal loans are typically unsecured loans, which means you do not need to put in any collateral to apply for one. Collateral is a form of assurance that is given by the borrower in the event of a default loan payment, for example, a car or piece of expensive jewellery.

An unsecured low interest rate personal loan is a popular choice for borrowers who do not have any valuable assets that can be used as collateral, or are not comfortable with the possibility of their assets being possessed if they fail to make timely payments.

How can you gain from taking low interest rate personal loans from legal money lenders in Singapore?

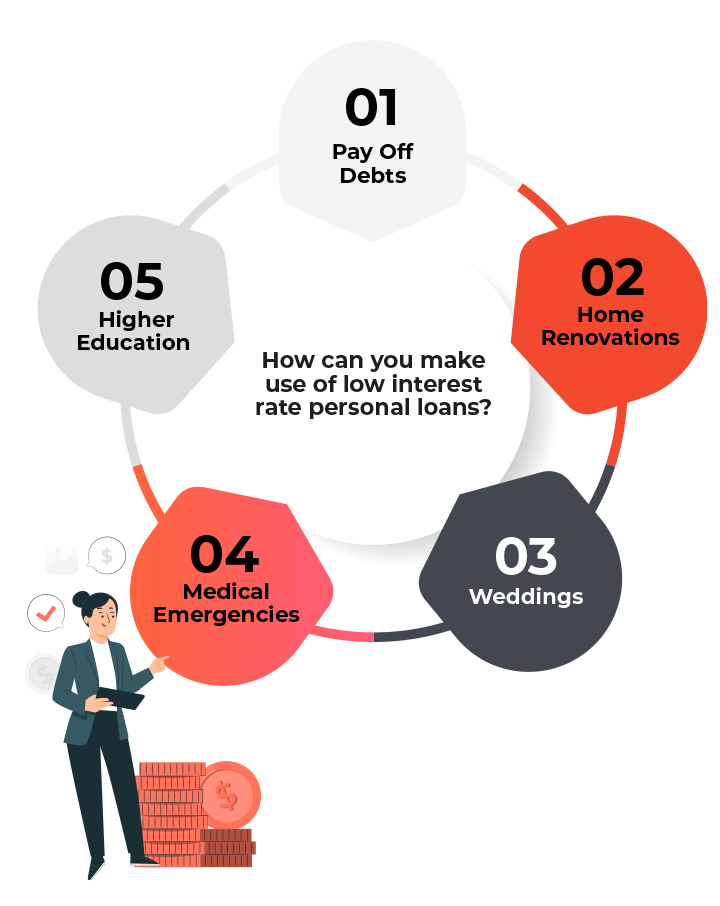

There are many ways to utilise them, such as:

1. Get out of debt

If you have multiple debts or loans with different lenders, you can consolidate these loans into a single one through a debt consolidation loan. In short, a debt consolidation loan lets you streamline all your different eligible unsecured loans into a single one, with a single repayment period, and usually at a lower interest rate.

This means the lender you take the debt consolidation loan from will pay off all your other multiple debts first — you only need to repay one loan from a single lender. You no longer need to be stressed about the different deadlines, interest rates, and repayment amounts.

2. Home Renovations

Building a dream home often requires significant renovation work and sometimes hidden costs which are not cheap. Renovation loans with low interest rates can help you build your ideal nest with minimal disruption to your cash flow.

3. Weddings

Weddings are expensive affairs in Singapore, and personal loans are a great tool to finance your dream wedding.

With a low interest rate wedding loan, you can plan a glitzy wedding without having to worry about your cash flow. Such a loan can be used for wedding-related expenses from videography to catering services.

Do remember to do your wedding budgeting well, though. Always remember this — a wedding loan is to help you with your cash flow, not for you to spend what you might otherwise not be able to afford.

4. Medical Emergencies

Sometimes, the unfortunate happens, and when we or our loved ones encounter medical emergencies, it can cause a lot of financial stress and cash flow problems.

You can take a medical loan to fund medical emergencies that your insurance does not cover or to tide you through the period while you wait for your insurance claims to be approved. Find out what you need to know before taking a medical loan.

5. Higher Education

Regardless of whether you are studying locally or abroad, it is common to take loans to fund your (or your children’s) higher education.

Study loans with low interest rates are good because payment may be deferred until after graduation so you (your children) can focus on your (their) studies first.

In summary, low interest rate personal loans are not only ideal for repaying comfortably within your financial means, but also useful for various purposes.

Apply for low interest rate personal loans from a licensed moneylender in Singapore

Ultimately, you can use low interest rate personal loans for a variety of personal expenses, especially emergencies, to ease your cash flow.

At Soon Seng Credit, we offer competitively priced low interest rate personal loans with flexible repayment periods. Just so you know, we offer fast approval rates, coupled with friendly, professional services.

Interested in our loan services? Simply apply for a low interest rate personal loan with us online now! Our loan officers will reach out to you in no time.

About the Author

Armed with years of experience crafting content for brands and companies across industries, Clio is ever-passionate about putting out top-notch, well-researched personal finance pieces that seek to educate.