SOON SENG CREDIT

Licensed Money Lender in Singapore | Trusted Chinatown Loan Company

We’re a reliable legal money lender in Singapore providing loans with affordable interest rates personalised to your needs.

Why We’re Your Go-To Licensed Money Lender in Chinatown

Google reviews in Singapore

Apply for a personalised loan with a trusted legal money lender in Singapore

A Licensed Money Lender in Singapore Which Strives to Meet Your Needs

Soon Seng Credit is a licensed money lender listed on the Ministry of Law’s Registry of Moneylenders. Our loan company follows all rules and regulations for legal money lenders in Singapore.

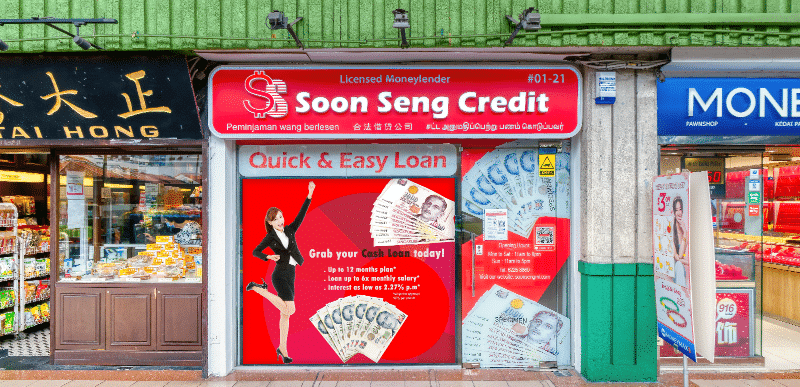

Apart from our straightforward money lender loan application process, we’ve also integrated Singpass Myinfo for even greater convenience. Accessibility extends to our authorised money lender office location too. As a licensed money lender in Chinatown, our central location is easy to visit for our valued customers.

As a veteran private money lender in Singapore, we boast an experienced and dedicated team with 30 years of industry expertise. We strive to establish long-term relationships, maintain complete transparency in our legal money lender services, and provide sound financial advice to our customers.

Our money lender loans are unmatched in variety. Whether you’re looking to renovate your home or enrol into higher education, Soon Seng Credit offers loans for any financial situation. We are a licensed money lender in Chinatown you can count on to deliver.

We’re a reliable money lender in Singapore that customises loans and repayments terms to meet your needs.

A Peek at Our Chinatown Money Lender Office

Frequently Asked Questions About Money Lenders in Singapore

Who are licensed money lenders in Singapore?

A legal money lender in Singapore is a business that has been authorised and licensed by the government to lend money to members of the public. Each legalised private money lender in Singapore is under constant scrutiny to abide by the Moneylenders Act.

Every registered private money lender in Singapore has gone through a stringent process to earn their money lender licence.

Are licensed money lenders the same as loan sharks?

A legal money lender in Singapore is NOT an ‘ah long’ or loan shark. In fact, they couldn’t be more different. Foremost, a legal money lender’s loan is thoroughly legal. Read our article to learn about other common misconceptions regarding licensed money lenders in Singapore.

Are all licensed money lenders in Singapore the same?

Of course not. We cannot speak for other money lenders, but we pride ourselves on offering top-notch customer service, affordable rates, flexibility, transparency and convenience to all our borrowers.

Are licensed money lenders inclusive?

For sure! Licensed money lender loans are available easily and conveniently to all, regardless of their nationality, income and credit scores. The eligibility criteria are really easy to meet!

Do licensed money lenders have to explain all loan terms and conditions?

Yes, licensed money lenders are expected to clearly explain all loan terms and conditions to the borrower when reviewing the loan contract with them. This must be done in a language that the borrower understands so they have full comprehension of everything the loan agreement entails, including crucial details such as the interest rate, fees, payment schedule, etc.

Where can I find a list of licensed money lenders in Singapore?

You can find an updated list of licensed money lenders on the Ministry of Law’s Licensed Money Lender registry. If the local money lender you are approaching is not on this list, beware – they could be illegal.

Are money lender loans fully customised to my needs?

While we can’t speak for every private moneylender out there, what we can say is that Soon Seng Credit has grown into a trusted name because we genuinely care about the people who come through our doors. Every borrower’s story is different, and we take the time to understand yours. That’s why our loans are never a fixed template — we shape each package around what you really need and what you’re comfortable with.

Take our study loans, for example. They were created with full-time students in mind — especially those feeling the pinch of rising education costs. And for homeowners juggling timelines, our bridging loans are designed to ease the stress of buying a new place before the proceeds from your current home come in.

At the heart of it, our goal is simple: to help you move forward with clarity, confidence, and the steady support of a team that truly wants the best for you.

Do I need guarantors for my legal money lender loan?

No, you don’t need guarantors in order to take out loans with us.

How can I apply for a licensed money lender loan?

Applying for your money lender loan takes seven steps:

1

Fill out the consent form and sign the money lender loan application form in the Soon Seng Credit office. Alternatively, you may also apply online through our website. As a reliable money lender in Singapore with loan applications round-the-clock, you can apply with us any time.

2

We will perform credit checks on your income documents.

3

We will then carry out a credit assessment and a short interview with you to better understand your financial needs.

4

We will discuss the loan amount and repayment terms with you.

5

Once your loan is approved, we will walk you through the loan offer’s details to ensure you understand the contract’s terms and conditions in entirety.

6

Sign the loan contract once you are agreeable with the terms.

7

The entire process will take less than 30 minutes. We will then disburse your funds via cash or PayNow instantly.

What are your private money lending rates and other fees?

We’re a legal loan company in Singapore that offers interest rates from 2.5-4%* per month for personal loans and 4-8%* per month for business loans. Our processing fee is around 5-10%* of your approved principal loan amount. Additionally, we may levy the following charges for your money lender loan:

| Late Payment Fees: | Legal Costs: |

|---|---|

| Rest assured that this fee for late repayments will not exceed S$60 per month the instalment is repaid beyond the due date | We will only charge the amount instructed by the court for a successful reimbursement of costs incurred to recover the loan (should you default on it) |

Lastly, do note that the total charges we apply – the combined value of processing fees, loan interests, late interests, and late fees – cannot exceed the loan principal amount.

*T&Cs apply

What is the eligibility criteria to apply for a loan from a money lender?

When borrowing from a licensed money lender, you must be between 21 and 65 years old and have a regular income source.

What’s the maximum money lender loan amount I can borrow?

The maximum money lender loan amount you can borrow greatly depends on your income:

| Annual income | Singapore Citizens and Permanent Resident | Foreigners residing in Singapore |

|---|---|---|

| Less than $10,000 | $3,000 | $500 |

| Between $10,000 and < $20,000 | $3,000 | $3,000 |

| $20,000 and more | 6 times of monthly income | 6 times of monthly income |

What’s the minimum income requirement for licensed money lender loans?

This may surprise you, but there is absolutely no minimum income requirement if you’re looking to take up loans from licensed money lenders in Singapore. We are happy to provide loan solutions regardless of your earning power.

What benefits* can regular clients or clients with a good credit history enjoy?

If you’re a regular client with us, a trustworthy money lender in Singapore, or a client with a good credit history, you stand to enjoy the following benefits:

Loan Terms

Interest rates

There is a possibility of reduced interest rates for regular and long term clients of ours.

Repayment terms

We can provide longer repayment terms so that clients are more comfortable with their monthly instalments.

Loan amount

We can provide a higher loan amount for clients who need it based on their long-standing relationship with us.

Processing Fees and Time

Processing time and approval speed

You can get your loan approved within 15 minutes.

Processing fees

You might receive a special discount on the money lender loan’s processing fee.

Other Perks

Free credit report and statement of account (SOA)

We provide a free credit report from Credit Bureau Singapore to all regular clients so that they can monitor their own credit health. We also provide statements of account (SOA) to all clients so they can keep track of their outstanding repayment amount.

Late charges

A grace period is given to regular clients if any late repayment occurs. This enables them to avoid late charges.

Payments

We also provide payment due date reminders and customised payment due dates.

Opening hours

We are happy to arrange for special opening hours at our registered money lender office to assist our regular clients who need urgent access to funding.

Early settlement

We allow regular clients to prorate their interest rates in the event of early settlement of loans.

Payday loan

You may qualify for a payday loan at 0% interest rate.

Special loan scheme

Our loan officers are able to arrange a special loan scheme for regular clients or clients with a good credit score.

Financial planning

We provide professional advice on financial planning, empowering you to manage your debts wisely.

Second loan application

Our regular clients may qualify for a second loan after careful consideration by our loan officers.

Approval rate

For clients with good credit history, you will likely get a higher approval rate for all loan requests.

Dedicated loan specialist

As an authorised money lender in Singapore, we have a team of professional and dedicated loan specialists waiting to serve you for all your financial needs.

Live repayment updates

We provide live repayment updates on a regular basis to allow clients to manage their finances in a timely manner.

*T&Cs apply

Can I still apply for a loan when I have a bad credit score?

Yes, you can. However, having a bad credit score may affect your money lender loan terms, such as interest rates and repayment terms. It is also important to understand the different types of loans available, such as secured vs unsecured loans, as your credit score may influence which type you qualify for.

Speak with our loan officer today for a clearer picture on how you can enjoy competitive interest rates with flexible repayment terms.

Should I choose a bank or licensed money lender online?

When most people think of getting a loan, their first instinct is to approach a bank. Banks have been around all our lives and they have good reputations as well as very large reserves of cash. To the ordinary person, licensed private money lenders in Singapore may not even seem like an option.

In truth, a legal money lender in Singapore can offer terms and deals that are attractive to the borrower. Additionally, not everybody can qualify for a bank loan.

Here are the key differences between applying for a loan from a registered money lender versus a bank:

| Bank | Licensed money lender | |

|---|---|---|

| Eligibility for loan |

Stringent:

|

Less strict

|

| Documents needed | More documents need to be furnished | Fewer documents need to be furnished |

| Loan approval time | Up to 2 weeks | Less than 30 minutes |

| Disbursement | To a bank account | To a bank account or in cash |

| How to apply | Online or at a branch office | Walk-in to the office or online application (in-person verification is still required by law) |

| Maximum loan | Up to 10X monthly income | Up to 6X monthly income |

| Repayment period? (Personal loan) |

Up to 7 years | Usually up to 12 months. Up to 24 months only on a case-by-case basis |

| Interest rate | 3.5-6% per annum | 1-4% per month |

| Processing fee | 1-2% of the loan amount | Up to 10% of the loan amount |

To learn more, check out our money lenders vs banks loan guide.

Is it necessary to meet my licensed money lender?

Yes, it is mandated by law that you visit your licensed money lender’s office for identity verification and a quick credit assessment as part of the loan process. This is true even if you’d opted to apply for the licensed money lender loan online.

Can I arrange to meet my legal money lender at public spaces?

Unfortunately, no. You are required to meet your legal money lender only at their registered place of business.

Is your money lender office open on Sundays?

Yes, we are happy to receive you if you intend to pop by on a Sunday. Our office hours on Sunday are from 11am to 5pm.

Why should I borrow from a legal money lender in Singapore?

There are four reasons why you should borrow from a legal money lender in Singapore:

Easy

Eligibility

Forgiving eligibility criteria from most licensed money lenders mean almost anyone can qualify.

A Simple Loan

Application Process

It’s easy to apply for a money lender loan, with few documents required.

Fast

Approvals

Instant money lenders can approve a loan in under 30 minutes.

Immediate

Cash Disbursal

Your licensed money lender loan can be disbursed to you in cash instantly after the loan contract has been signed.

Are my private details safe with licensed money lenders?

Reputable licensed money lenders like Soon Seng Credit prioritise privacy protection. Your personal details and information are all secure and kept strictly confidential with us.

How do I find reliable money lenders near me?

One simple way to find a reliable money lender near you is to use Google Maps and search “licensed money lenders near me”. Take the time to compare local money lender ratings on Google to find a reliable money lender in Singapore you can count on.

It’s important to read their reviews before contacting any of them. You can also use Google and search for “licensed money lenders in Singapore reviews” to check if there are any red flags, such as complaints of harassment or unfair loan terms in forums.

Additionally, cross-check the business’s details with the list of licensed money lenders online on the Ministry of Law’s website for their official addresses, contact details, licence numbers, etc. You can refer to our guide on checking a money lender’s licence for more information.

How do I identify an illegal money lender in Singapore?

Here are three ways to identify an illegal money lender in Singapore:

1

The private money lender is not registered with the Ministry of Law

2

The local money lender does not have a registered office. Instead, they would ask to meet in public places or not meet you in person at all

3

The money lender advertises its services via SMS, WhatsApp, WeChat, Facebook, or email

However, sometimes, the signs only become obvious when the money lender is processing your loan application. For example:

- The private money lender asks for your SingPass or other login credentials as well as the passwords

- The money lender insists to keep your original NRIC, FIN card, or passport

- They ask you to sign an incomplete loan contract or do not give you one at all

For more helpful information, read our articles on spotting and dealing with illegal lenders and identifying the red flags that illegal lenders show.

How can I effectively negotiate terms with an authorised money lender in Singapore?

Local legitimate money lenders are not as rigid as banks when discussing the terms of a loan. When you’re ready to get a loan from the money lender, ask for the best deal possible, as well as clauses. Here’s how you can effectively negotiate the following money lender loan terms:

Interest rate

This is dependent on your creditworthiness and repayment history. To learn more, read our guide on licensed lenders’ interest rates.

Repayment period

Try to get the maximum two-year repayment period from the authorised money lender if your budget is tight

Penalties

More lenient penalties from the licensed money lender will let you absorb small missteps and still pay your debts

Instalment due date

Schedule your repayment’s due date for payday, or just after it so you will have the required cash on hand

Repayment channels

Depending on your preference, you may ask to make loan repayments in cash, bank transfer, PayNow, or another mutually agreed method with the private money lender

Are licensed money lender loans legally binding?

Licensed money lender loans are legally binding and it is your responsibility to clear your debts according to the repayment terms stated in the loan contracts. You should always give them serious consideration before taking up any of them!

Should I borrow the maximum loan amount available to me?

Just because you can borrow the maximum loan amount doesn’t mean you should. As always, only borrow what you need and can repay on time.

How do I settle licensed money lender loans promptly?

Once you have signed on the dotted line and received your loan, you have also gained responsibility. All borrowers should follow these guidelines when repaying a loan to an authorised money lender in Singapore:

Borrow only what you can afford to repay

Read the money lender loan contract carefully. Know each instalment’s exact due date and the penalties for skipping or making late repayments

Read the legal guidelines for borrowing from a licensed money lender. Don’t let carelessness or ignorance cost you money

Make loan repayment your priority ahead of all casual expenses

Ask for receipts when you make repayments to the licensed money lender and take screenshots of all online transactions

Do NOT turn to illegal money lenders

To further improve your financial habits, check out these helpful resources on loan repayment tips to clear debts early and keeping your finances healthy.

What happens if I am unable to pay money lenders in Singapore?

If you’re having trouble with repayment, inform your licensed money lender as soon as possible. More often than not, your licensed money lender will be happy to negotiate and work out a repayment plan that benefits both parties. After all, they would want you to repay them as much as possible.

If you are unable to pay off your loan despite your best efforts, a licensed money lender has a set procedure to follow:

1

The money lender will send a Letter of Demand (LOD) to your home or office. This document contains the details of the loan, the outstanding amount, a list of additional fees and charges, and other relevant information. The LOD states a due date before further steps are taken.

2

If the money lender loan is not repaid past the due date in the LOD, the legal money lender may send debt collectors to your home or office. Debt collectors are only allowed to request payment. They are prohibited from using intimidation and harassment, issuing threats, and violence.

3

The final step that a money lender can take is to bring formal court proceedings against you, the debtor.

How should I handle licensed money lender harassment?

No legitimate money lender or their outsourced debt collectors are allowed to confiscate belongings as ‘collateral’ until the debt is paid. They also cannot vandalise or damage a debtor’s home or possessions.

If you believe a private money lender is acting illegally, make a formal complaint to the Registry of Moneylenders online or call them at 1800-2255-529. You may also contact the police at 999 to report any illegal or threatening behaviour.