Are you interested in taking out a loan, but are unfamiliar with the different types of loans available?

The concept of taking a loan in Singapore is rather straightforward. It simply means that you are borrowing a certain sum of money from a lender, usually a bank or a licensed money lender, with specific terms and conditions outlined in a contractual loan agreement.

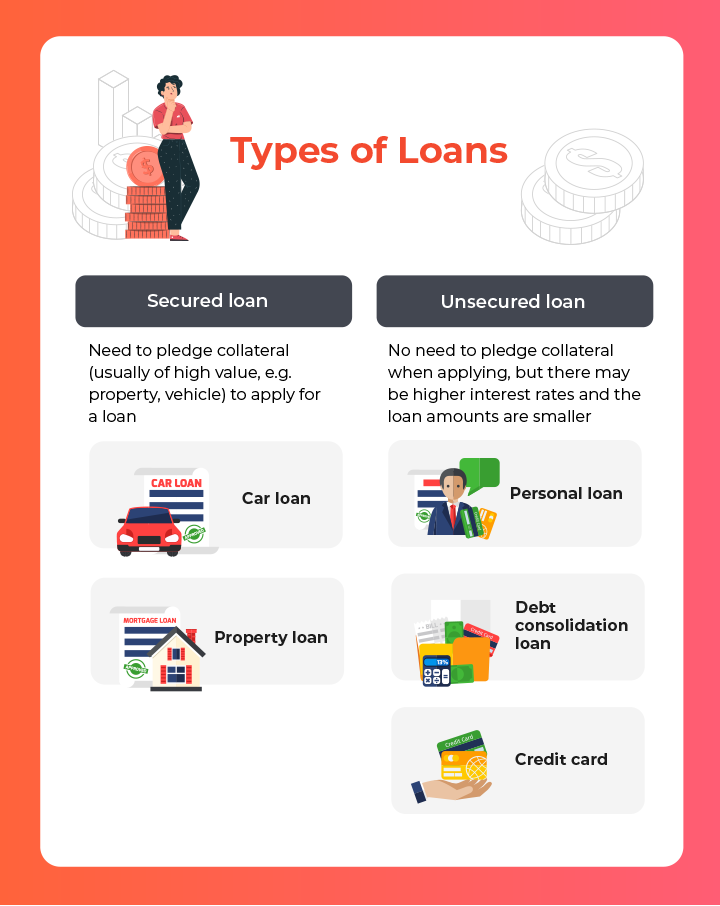

Loans are generally divided into 2 broad categories – secured loans and unsecured loans. Below, we will break down what these two loan categories mean and share with you which is usually a faster and easier loan option.

What is a secured loan?

Secured loans are loans given to a borrower that are secured by collateral. This means that when the borrower takes out a loan, they are pledging the collateral as a form of ‘security’ with the lender.

If the borrower defaults on the loan, the lender has the right to seize and liquidate the collateral to recoup their losses.

Hence, collaterals pledged are usually assets of high value, such as property, cars, expensive pieces of jewellery, antiques, or even rare art pieces. However, if there is a shortfall after monetising your collateral, you would need to top up the difference.

Taking a secured loan can provide the lender with peace of mind. This is why in the event you do not meet the eligibility criteria for an unsecured loan with a licensed money lender, you stand to have a higher chance of getting your loan approved if you take a secured loan.

Banks and licensed money lenders will also generally be willing to offer you secured loans such as a property loan or car loan as there is collateral pledged to it.

What are the common types of secured loans?

1. Car loan

You can take up a secured loan for a car purchase either with the bank or a licensed money lender. In this case, you are pledging your car as an asset – which means if you default on your loan, the bank or money lender has the right to seize your car.

You will need to adhere to the Total Debt Servicing Ratio (TDSR) cap of 55%, which is the portion of a borrower’s gross monthly income that is used to repay all their loans, as well as the maximum Loan-To-Value (LTV) ratio of your car loan, which is 60-70%, depending on the open market value of your car.

The LTV is your total loan amount divided by the purchase price of your vehicle, including taxes and COE, expressed as a percentage.

2. Property loan

A property loan is a loan you take out to purchase a property. Similar to car loans, it is also a secured loan whereby your property is used as collateral. As per the rules for new housing loans, you will need to adhere to TDSR of maximum 55% as well the Mortgage Servicing Ratio (MSR) of maximum 30% if you are taking a loan to purchase a HDB or Executive Condo (EC).

MSR is the portion of a borrower’s gross monthly income that is used to repay all of their property loans for HDB flats and ECs.

What is an unsecured loan?

Unsecured loans are not backed by any form of security or collateral. These are quick and easy loans to obtain when you need fast cash in Singapore.

Since there is a higher risk for the lender for unsecured loans, the interest rates tend to be higher and the loan amounts are smaller.

Any defaults in payments will hurt your credit scores for future loans, which will affect your creditworthiness for all other loan applications as well.

What are the common types of unsecured loans?

1. Personal loans

Personal loans are usually unsecured loans that are offered in small loan amounts. The maximum loan amount you can borrow depends on your annual income.

There are no restrictions on what you can use personal loans for. From wedding loans, renovation loans to medical loans – you can use it for any personal expenses. If you enjoy being on the road, you can even get a Grab/Gojek loan as a private hire driver.

You can also benefit from payday loans if you simply require some cash flow before your salary comes in.

The interest rates for personal loans with the bank can range from 3.5-11% per annum, and 1-4% per month with a licensed money lender.

Most people opt for this loan as it is a quick, easy, and fast cash option that can be used for most purposes.

2. Debt consolidation loan

A debt consolidation loan is a debt refinancing method that allows the borrower to consolidate all their existing loans into a single loan – in short, taking out one loan to pay off all outstanding loans, usually at a lower interest rate than their existing loans.

This allows the borrower to concentrate on paying off just one single loan with one money lender without worrying about multiple interest rates and repayment deadlines, which can be tough to juggle.

Overall, a debt consolidation loan will help borrowers clear their debts more quickly and reduce the risk of incurring late fees on their loans.

3. Credit card

This is the money you borrow when you use your credit card to make a purchase. How credit card interest and charges work is that the bank loans you the money upfront and charges you high interest if you do not pay within the stipulated time frame.

Hence, it is important that you pay all your credit card bills on time to avoid accumulating debt.

Which is a fast and easy loan option – secured or unsecured?

Before taking any loan, you need to understand your financial needs as well as the consequences of both types of loans. Do you need a small loan amount fast? Or do you need a larger loan amount for a home purchase with a longer loan tenure?

Both secured and unsecured loans have their advantages and disadvantages.

Keep in mind that for secured loans, you might end up losing your collateral if you are unable to service your loan repayments. However, the interest rates for secured loans are usually lower than the interest rates for unsecured loans.

On the other hand, unsecured loans are usually faster and easier to apply for. While personal loan approval with the banks can take up to two weeks, applying for a personal loan with licensed money lenders will usually only take less than 30 minutes to be approved, if you meet the eligibility criteria and are able to furnish all required documentation.

Unsecured loans also have shorter loan tenures – for example, up to five years loan tenure for a personal loan from the bank and up to twelve months for a personal loan from licensed money lenders.

If you are taking a loan from the bank, do note that they will examine your credit score as well, which will affect your loan application approval. However, you can usually still get a loan from licensed money lenders even if you have a bad credit score.

Hence, unsecured loans with licensed money lenders are the best option for borrowers who require fast short-term loans or urgent loans in Singapore for a relatively small loan amount.

As the top Chinatown licensed money lender, Soon Seng Credit provides reliable, fast, and easy loan options for those of you who require a loan quickly.

Simply apply with us and our friendly loan consultants will get back to you in a jiffy.

About the Author

No fuss, No stress. You can count on me to get the facts right.